Sat Management consultancy is the best ACCOUNTING CONSULTANCY IN ABU DHABI and accounting firm in Abu dhabi and dubai

Accounting Services in Abu dhabi

Accounting Services in Abu dhabi

SAT Management Consultancy offers comprehensive accounting services and supervision on a monthly and part-time basis to meet the unique needs of your business. Our dedicated team of professionals ensures accurate and timely management of your financial records while providing ongoing supervision to optimize your accounting processes. Here’s how we can assist you:

1. Accounting Services:

- Bookkeeping: We handle day-to-day recording of financial transactions, ensuring accuracy and completeness of your financial records.

- Financial Reporting: Our team prepares monthly, quarterly, and annual financial statements, providing you with clear insights into your business’s financial performance.

- Accounts Payable and Receivable: We manage your accounts payable and receivable processes, ensuring timely payments and efficient invoicing to maintain healthy cash flow.

- Bank Reconciliation: We reconcile your bank statements with your accounting records to identify any discrepancies and ensure accuracy in financial reporting.

- Expense Management: We track and categorize your business expenses, helping you monitor spending and identify opportunities for cost savings.

- Payroll Processing: Our services include payroll processing, including calculation of wages, deductions, and tax withholdings, ensuring compliance with payroll regulations.

2. Accounting Supervision:

- Process Optimization: We evaluate your existing accounting processes and systems, identifying areas for improvement to enhance efficiency and accuracy.

- Training and Development: Our team provides training and guidance to your in-house accounting staff, ensuring they have the necessary skills and knowledge to perform their roles effectively.

- Internal Controls: We help implement internal controls and procedures to safeguard your assets, prevent fraud, and ensure compliance with regulatory requirements.

- Financial Analysis: We conduct regular financial analysis to assess your business’s performance and identify opportunities for growth and improvement.

- Regulatory Compliance: Our experts stay up-to-date with changes in accounting standards and regulations, ensuring your business remains compliant with applicable laws and regulations.

With SAT Management Consultancy, you can rely on our expertise and dedication to ensure the smooth operation of your accounting functions. Whether you need ongoing accounting support or supervision to optimize your processes, we are here to assist you every step of the way. Contact us today to learn more about our accounting services and how we can help your business succeed.

Accounting Services in Abu dhabi

Accounting Services means the measurement, processing and communication of financial information about economic entities including, but is not limited to, financial accounting, management accounting, auditing, cost containment and auditing services, taxation and accounting information systems.

Choose the services you desire to offer clients. Select bookkeeping services to offer clients, such as accounts receivable, accounts payable, bank reconciliation, payroll and financial report preparation.

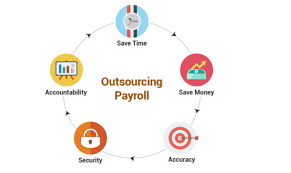

outsourcing is the long-term contracting of a company’s business processes to an outside service provider, helping to increase shareholder value by reducing the costs of non-core functions. … You want professional-grade accounting, but it’s either too costly or you don’t need full.

Outsourcing your accounting services is applicable for your current situation if:

- You are spending too much time managing your books while neglecting other aspects of your business

- You are cutting corners because you don’t really understand how to do bookkeeping properly

- You want professional-grade accounting, but it’s either too costly or you don’t need full-time accounting services

- You need “at a glance” financial reports to stay informed about your business

- You aren’t afraid to ask questions about financial data you don’t understand

Using accounts payable outsourcing is when your company hires a third party to process all of your business’s AP process. Third-party AP providers have all of the skills, tools, and technology they need to manage your company’s existing accounts payable functions.

Maintaining the book of accounts from the date of incorporation plays a very crucial part for any business. However, start-ups and SME’s set up at a small scale and might even miss certain transactional recordings due to lack of finances, but within a year or two of the business establishment, they do realize the importance of accounting records and track down of the finances.

The UAE serves as a base for start-ups and SME’s and helps the business entities to get an international exposure. When it comes to business establishment in the UAE, the commercial law of the country makes it a mandate to maintain proper records. Be it at the later stage, but it becomes a mandate for a business entity to update its backlog accounts so as to keep a proper check on the company’s financial flow. If you have recently initiated your business, then you should know that the accounting services play a crucial role and the backlog accounts are to be updated. This article will give you the insights of maintaining the backlog accounts.

Accounting Supervisors ensure that all financial and accounting operations within an accounting department run smoothly. They oversee the work of junior accounting staff, review financial statements to ensure accuracy, and reconcile general ledger accounts.

Accounting Supervisor Requirements:

- Bachelor’s degree in Accounting, Finance, Business Administration, or related field.

- Certified Public Accountant (CPA) accreditation.

- Proven experience working as an Accounting Supervisor.

- Sound knowledge of accounting principles and practices.

- The ability to process large amounts of numerical data.

- Proficiency in Microsoft Excel and accounting software.

- Excellent analytical and problem-solving skills.

- Strong management and leadership skills.

- Effective communication skills.

- Detail-oriented.

Accounts reconciliation is the process of verifying an organization’s financial records and transactions in order to detect discrepancies, if any and to reconcile the same. Efficient bank account reconciliation is vital for auditors to determine the correctness of a company’s financial statements and to ensure compliance with regulatory/ statutory requirements.

Since accounts reconciliation services is an activity that requires painstaking effort and an eye for detail, it is best outsourced.

- Put cutoff policies in place. …

- Keep it timely. …

- Design a coding cover sheet. …

- Batch items to process. …

- Insist on oversight. …

- Resist crunching numbers outside of your accounting software. …

- Review your accounting system processes. …

- Share your accounting function.

Placement assistance is something where the institute helps you to prepare for interviews with major companies, career counselling, provides guidance on writing resume, fills out job applications etc. It helps you to find suitable jobs and positions.

Education and training. Most accountant and auditor positions require at least a bachelor’s degree in accounting or a related field.

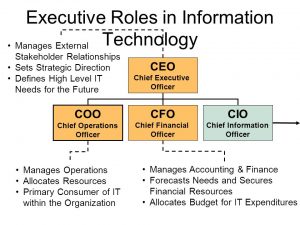

The most common C-suite titles are chief executive officer (CEO), chief financial officer (CFO), and chief operating officer (COO). These C-suite leaders, also known as C-level executives, make decisions that can determine success or failure for their companie Manages External. Stakeholder Relationships. Sets Strategic Direction. Defines High Level IT. Needs for the Future. CEO. Chief Executive. Officer. COO. Chief Operations. Officer. CFO. Chief Financial. Officer. CIO. Chief Information. Officer. Manages Operations. Allocates Resources. Primary Consumer of IT within the Organization. Manages Accounting & Finance. Forecasts Needs and Secures Financial Resources. Allocates Budget for IT Expenditures.

The chief executive officer is the highest-ranking overall position in the entire company, while the chief financial officer is the highest-ranking financial position. … The CFO reports directly to the CEO.

Payroll outsourcing is simply the use of a service provider to handle the administrative and compliance functions of paying employees. It is important to note that payroll services are only that, and do not offer a local employer of record for the foreign company.